03.24.2021: This article was published early in the COVID-19 pandemic and refers to stimulus funds provided by the CARES Act only. Information about the most recent stimulus provided by the American Rescue Plan (or any unclaimed COVID-relief funds) is available here.

Congress passed a $2.2 trillion coronavirus relief bill on March 27 that President Trump signed into law the same day. This third legislative action in response to the COVID-19 pandemic is the largest aid package in history and includes nearly $300 billion for direct payments to low- and moderate-income Americans. The infectious disease has killed 2,860 U.S. residents as of March 31 and brought the economy to a grinding halt. However, many people who were already struggling before the outbreak are at risk of not receiving the stimulus payment, according to the director of the D.C.-based nonprofit Capital Area Asset Builders.

“Anyone with a Social Security number who is not a dependent of anyone else should be eligible for a check under the income caps,” Sen. Chuck Grassley (R-Iowa) said on the Senate floor on March 25. Grassley chairs the U.S. Senate Finance Committee.

Adults who earn $75,000 or less per year should receive $1,200, while that amount will reduce on a sliding scale for people who earn up to $99,000. Anyone with a higher income will not qualify. There is no minimum qualification. This amount applies to each member of a married couple and families will receive an additional $500 for every dependent child under 17.

The payments are classified as advance tax rebates and will not be taxed. The legislation amends the tax code and tasks the Internal Revenue Service with distributing them using information from tax returns filed this year. For anyone that has not filed yet, last year’s returns will be used. A similar approach was taken for direct payments included in the Economic Stimulus Act of 2008.

What about people who are not required to file taxes, such as individuals who earn less than $12,200 and couples who earn less than $24,400? Federal earning thresholds for singles and couples who are considered to be in poverty are near or below those IRS benchmarks: $13,064 and $16,815, respectively. The most recent Census Bureau data available show that 11.8% of Americans were impoverished in 2018 — 38.1 million people. In 2019, 32% of homeless single adults and 46% of homeless adults in families in the D.C. metropolitan area reported employment as their primary source of income.

The bill states that if a 2018 or 2019 tax return is not available, information should be used for anyone who received a Social Security Benefits Statement this year, a tax form typically mailed in January that notes how much income someone received from the Social Security Administration the previous year through benefits such as disability or retirement.

“Let’s just look at a low-income or no-income individual who did not file taxes and did not receive social security,” said Leitmann-Santa Cruz, the Capital Area Asset Builders director. “It is prudent to assume that person is not likely to get any money. And that is primarily because imagine the amount of research that would have to be done to identify that person.”

Those who are homeless, undocumented, or underemployed are virtually non-existent, according to Leitmann-Santa Cruz.

An inspector general’s evaluation of the 2008 stimulus payments found that of the roughly 20 million non-filers the IRS identified by working with the Social Security Administration and Veterans Affairs, 3.4 million who were eligible did not receive the stimulus.

“Imagine if a person only claimed [unemployment insurance] in D.C. a couple of years ago. That’s 100% D.C. money,” Leitmann-Santa Cruz said. “It’s not like a bureaucrat from the federal government would be doing so much research to identify such an individual.”

Economist Claudia Sahm of the Washington Center for Equitable Growth agreed that the least well-off people will have to wait longer to get this money and are more likely to fall through the cracks. But she is adamant that the Treasury Department will build a system that allows individuals who do not file taxes and do not receive federal benefits to identify themselves. Sahm worked for the Federal Reserve Board for 12 years, including through the Great Recession.

She cautioned against fear over this uncertainty until the IRS issues its guidance in the coming weeks on how they interpret the legislation. “They have to follow what Congress told them to do, but what I learned from hours of staring at legislative text is, it’s not trivial to figure out exactly ‘what did they say they want done’ and then ‘OK, that’s what they want, how can we actually make that happen?’” Sahm said.

Once they interpret the bill, the agency will have to determine how they want to make it operational, such as by creating a web interface where people can provide their Social Security Number and direct deposit information or current address, before publishing guidance on how to participate.

Sahm noted that no-income or low-income people who have not filed tax returns or received SSA benefits are entitled to the payment but they will probably have to go to some effort to show they qualify. She pointed out that any time federal money is being distributed there is potential for fraud. “So … [people who don’t file taxes or receive SSA benefits] are going to get the money, they’re supposed to get the money, [but] there will be an expectation that those individuals will have to raise their hand and say, ‘Hey, I want my money’…if that person doesn’t come forward and say ‘I want my money,’” she said, “the government’s not going to find them and send them their money. So people are going to have to choose to sign up, and we don’t even know how they’re going to choose to sign up yet. So then that means, with almost certainty, it will take more time.”

In the same way the government will have to work to prevent fraudulent claims, Sahm stressed that consumers should await information from official sources, like the IRS guidance. Scams posing as emails and calls to confirm contact and banking information have already been reported in Olympia, Washington.

In the meantime, disclaimers have been placed on both the IRS and Social Security Administration websites stating that no information is available yet.

Screenshot of ssa.gov/coronavirus

Treasury Secretary Steve Mnuchin said in a March 25 press briefing that payments to anyone who provided direct deposit information on their tax return should begin showing up in taxpayers’ bank accounts within three weeks. Four days later, during an interview with CBS, Mnuchin said the IRS will also develop an online system to allow anyone who did not submit direct deposit information on their return to supply that information if they do not want to wait for a check in the mail.

In addition to interpreting the legislation, the time delay exists because the IRS has to create a database of the millions of Americans who are eligible and all of their payment information. Once that dataset exists, it will be given to another Treasury agency that regularly processes payments. When that step is complete, direct deposit payments, which the majority of tax filers use, could be “pushed out” in as little as two days, according to Sahm. Checks will take longer because there are constraints on how many paper checks the federal government can issue in one week: hundreds of millions as opposed to billions. She estimates it will take four to six weeks for all of the payments to be received, if the IRS and SSA staff “hustle,” noting the staff worked around the clock to get out the 2008 stimulus checks.

“I think the three weeks that Mnuchin is talking about is, um, heroic. I mean, I hope he’s right … But four weeks is fast,” Sahm said. “For anybody who has a Social Security number but isn’t in these other groups, it will take longer. If the others are four-to-six weeks, we’re talking like early July or something. But again, those are exactly the people that needed the money like three weeks ago.”

Sahm referenced “three weeks” frequently because that’s how long it took Congress to craft its relief legislation. She describes the House and Senate as moving fast and implementing the right policies, but says the virus moved faster. Last year, Sahm proposed making direct payments to Americans an automatic response to crises and recessions, rather than something that would need to be planned and deliberated during an emergency. She made these recommendations in a chapter she contributed to “Recession Ready,” a paper produced by The Washington Center for Equitable Growth in partnership with a project of The Brookings Institution. She said it was well-received by some legislators before anyone knew what COVID-19 was and is optimistic about policies that might be put in place for the recovery of this crisis and especially to prepare for others down the road.

Leitmann-Santa Cruz still believes that the parameters that have been assigned to this legislation mean a good number of no-income individuals will be overlooked.

Even if people who don’t file taxes or receive federal benefits were automatically identified to receive their stimulus check, they would face obstacles. “A lot of people experiencing homelessness and low-income households don’t necessarily have banking accounts and so, if it’s a check being sent out, how then will it be cashed?” said Kim Johnson, a policy analyst at the National Low Income Housing Coalition. Johnson noted that “cash-checking places take such a large percentage of the check, taking from the actual money they will ultimately give someone.”

Just over 6,500 people were counted as homeless in the District last year, with 83% of them identifying as Black or African American. In the District of Columbia, approximately 5% of the population is undocumented. This is about 35,000 people, who, according to Leitmann-Santa Cruz, are mostly Latinx. Capital Area Asset Builders estimates that another 20,000 low-income families in D.C. do not claim the Earned Income Tax Credit, primarily because they do not file federal taxes. Between those demographics alone, more than 60,000 families in D.C., the majority comprising low-income residents and people of color, are at risk of not receiving any money from this bill.

Undocumented residents will be out of work, and possibly their homes, with no way to feed their families or sustain their lives, according to Leitmann-Santa Cruz. He wishes Congress would make a greater effort to streamline cash or some form of monetary relief for D.C.’s most vulnerable residents, regardless of their citizenship status. In 2014, the IRS estimated that tax filers who use an Individual Taxpayer Identification Number paid $9 billion in federal taxes. The ITIN is an identification number that was created in 1996 for workers who don’t qualify for a Social Security number. It was created for unauthorized immigrants, lawfully present individuals, and U.S. resident aliens/nonresident aliens, but is used predominantly by undocumented immigrants.

“The people in this country need greater liquidity of funds immediately,” Leitmann-Santa Cruz said, “but this discriminatory methodology in this bill will systematically discriminate against the people hurting the most.”

Several activist organizations in the D.C. area have organized fundraisers encouraging people to donate their stimulus checks to help their undocumented neighbors, DCist reported.

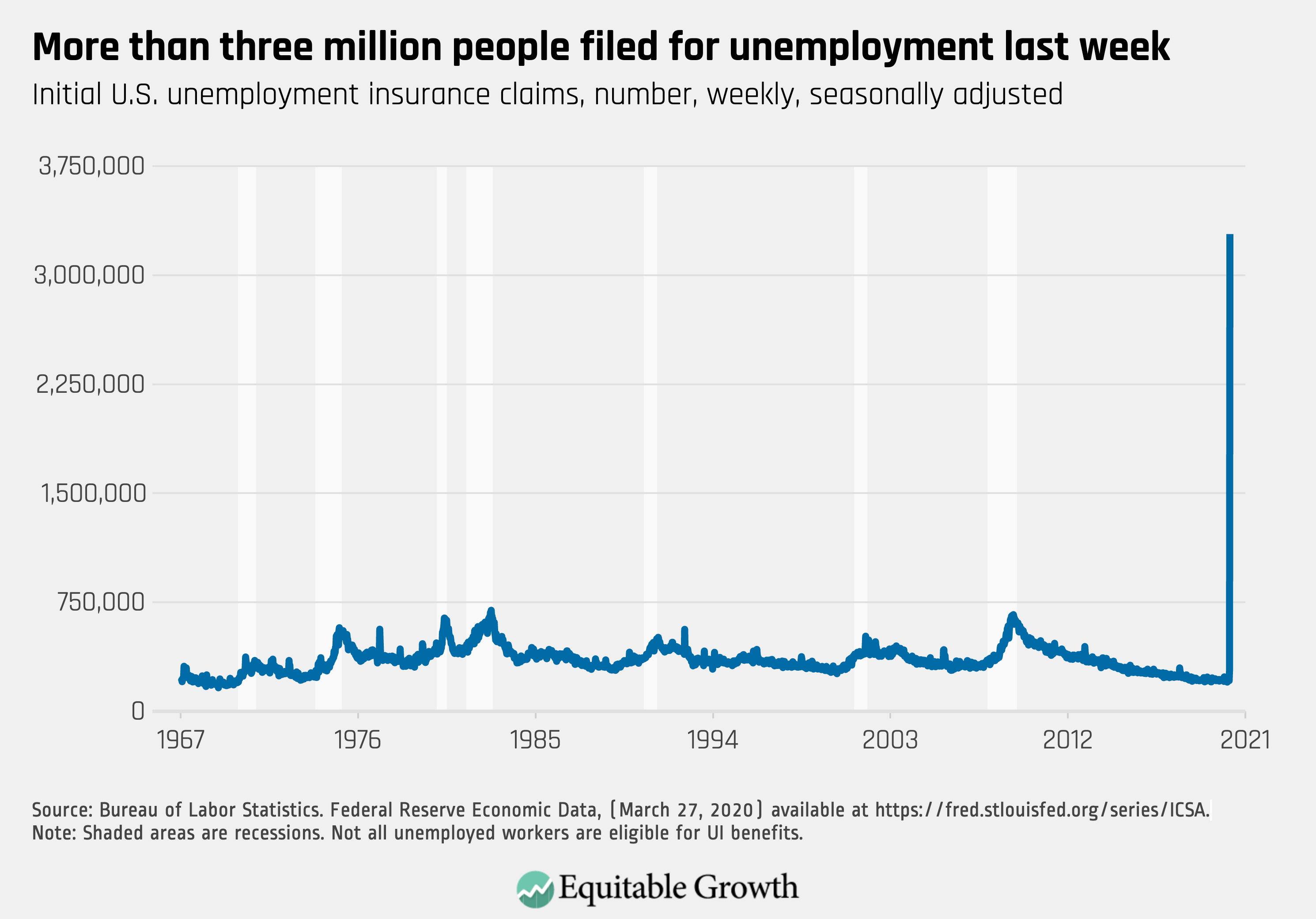

With the city’s unemployment rate nearly 30 times higher than it was two weeks ago amid rapidly changing public health guidelines, the full effect of this global pandemic remains uncertain.

People who are already dealing with unemployment, chronic homelessness, or living paycheck-to-paycheck, cannot afford to be out of work for extended periods of time, let alone survive an indefinite pandemic, with no financial relief, according to Sonya Acosta, another policy analyst at National Low Income Housing Coalition.

“You really want to keep people employed. This $1,200 check is not going to help someone enough who loses their job. Or [who] didn’t have a job to start with,” Sahm said.

I still think these checks are giving everybody a little bit of a cushion. But that’s not enough. We’ve got to try lots of different things, we’ve got to do them all at once, and we’ve got to move very fast.”

Courtesy of EquitableGrowth.org

The relief bill includes an expansion of unemployment insurance to be paid by the federal government and covers contractors, freelancers, and gig economy workers who would not normally be eligible for it and small business loans that will be forgiven as long as recipients keep their employees through the duration of the loan. It also includes financial grants for homeless services and housing and allocates $5 billion to HUD’s Community Development Block Grant Program, which can use the money to expedite homeless people into individual shelters as opposed to congregate settings, receive rent stabilization, and offer eviction prevention assistance.

The bill also funnels $150 billion to a national Coronavirus Relief Fund; however, D.C. was only allocated up to $500 million from this fund, while each state is allowed up to $1.25 billion. The difference is due to the District’s classification as a territory in the legislation.

Senator Chris Van Hollen of Maryland disputed the logic and fairness of this classification. “There are more residents in the District of Columbia, the Nation’s Capital, than the State of Wyoming and the State of Vermont. They were left out of that category they are usually put in, and instead, they were put into a formula with Puerto Rico, the Virgin Islands, American Samoa, and some of the territories. The net effect of that — the net effect of putting the people in the Nation’s Capital in that formula versus the formula with the States — will cost the District of Columbia about $700 million,” Van Hollen said on the Senate floor on March 25. “I asked about this. … The answer I got back was no. No, no, this was not a mistake. This was not an oversight. Republican negotiators insisted on shortchanging the people of the District of Columbia.”

The provisions on what the relief fund money may be used for are broad and policy analysts like Johnson say states could use this money to assist their homeless and undocumented residents. The bill also includes a grant of $4 billion in spending for the Emergency Solutions Grants Program, which would be used for emergency measures to prevent an outbreak of COVID-19 among people experiencing homelessness and very low-income households who are at risk of homelessness. The program also provides additional cautionary measures, such as emergency shelter and eviction prevention, according to a press release from National Low-Income Housing Coalition.

“I remain cautiously optimistic for those who are eligible to receive money from the federal government,” said Leitmann-Santa Cruz. “However, undocumented, homeless, and previously incarcerated people will take a significant hit.”

(UPDATE 04.12.2020)

The IRS announced on April 11 that the first round of direct-deposit stimulus payments has been distributed. Since this article was published, the IRS stimulus webpage has been updated to include a form non-filers who also do not receive benefits from the Social Security administration may use to enter their information and receive their stimulus payment. It also previews a not-yet-functioning “Get My Payment” form that the site says will be available in “mid-April” and will allow anyone who filed a 2018 or 2019 tax return to check on the status of their stimulus payment and provide or update their bank account information if they had not done so previously and wish to receive a direct deposit instead of a check. The page also links to instructions for how to provide the IRS an updated mailing address if needed.