Assistance for first-time homebuyers in D.C. is in high demand.

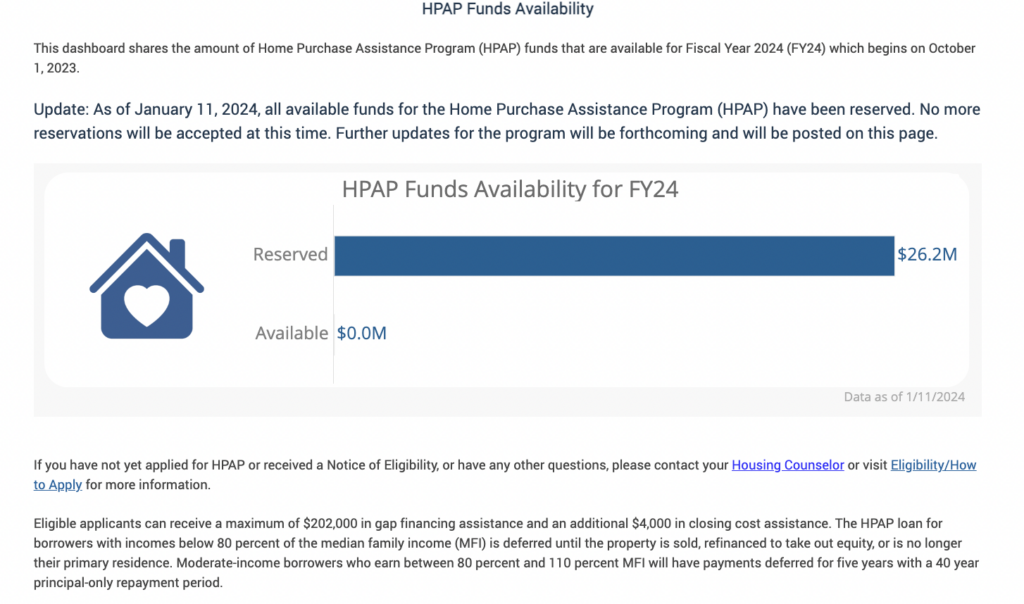

The District’s Home Purchase Assistance Program (HPAP) ran out of funds on Jan. 11, barely four months into the fiscal year. Though the program is designed to help potential homebuyers over an entire year, the HPAP portal indicated all $26.2 million of funds for fiscal year 2024 had been claimed, DCist first reported.

D.C. residents who were hoping to buy a house with the assistance of HPAP funds will have to wait until October, the start of the new fiscal year, to apply for aid.

For decades, HPAP has helped first-time homebuyers from low-and moderate-income backgrounds with down payments. Through offering interest-free loans, HPAP has eased financial burdens for lower-income individuals and families looking to purchase a home. Repayments for these loans are deferred until the property is sold, refinanced or when the house is no longer the homeowner’s primary residence. For moderate-income earners, repayments are deferred for five years. This is critical in helping applicants, the majority of whom are Black, build generational wealth, especially in an economically and racially segregated city with a high-cost housing market.

This is not the first time need has outpaced resources for homebuyers. Last year, HPAP ran out of funds in June, three months before its funding reset. Many applicants reported feeling caught off guard, according to reporting from DCist, because there was no formal communication from the Department of Housing and Community Development (DHCD) to inform them that funding was almost exhausted.

The D.C. government has long struggled with administering HPAP. The most recent shortfall in funding began when Mayor Muriel Bowser announced in 2022, the program would more than double the amount of funding applicants would be eligible to receive from $80,000 to $202,000. Yet the budget for HPAP remained the same, meaning that the number of people who could access HPAP funds was limited.

In October, DHCD introduced a new rule that capped loan assistance at 30% of the price of a house. This was presumably intended to allow more people to apply to HPAP by reducing the award any one person could receive. However, At-Large Councilmember Robert White voiced concerns that this new rule would shut off the opportunity entirely from low-income prospective homebuyers.

While the D.C. Council passed an emergency bill so applicants who had been approved for HPAP funding before this cycle can be exempted from these new rules, most Washingtonians still have to wait until this October before they can reapply for loan assistance.